These are scary days.

Nobody liked the bailout bill. But a lot believed it was better than nothing.

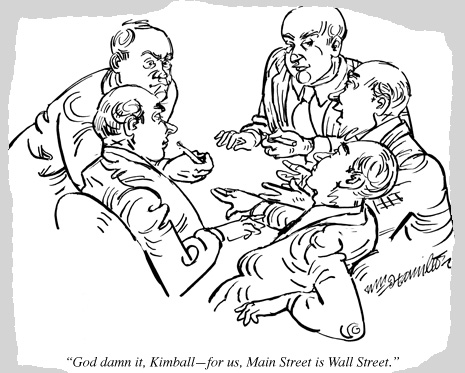

Yesterday and today’s market meltdowns would suggest they might have been right. Yet, at best the Wallstreet rescue package seemed like a case of damned if you do, lots more damned if you don’t.

Not pretty either way.

The fact that the democratic shot callers felt they had to settle for such a flawed plan in the first place, and that they did not take a few days longer in order to get a bill that their rank and file could more fully support, then tried to pass it prematurely without the requisite votes, showed a failure of will and of leadership.

Yet, it was far more troubling that so many Republicans voted against the bill for the most cynical of reasons—either out of ruinously childish partisanship or because they refused to be parted from some ideological “free market.” fantasy.

Whatever. It’s all blood-soaked water under the bridge now.

The question is, where do we go from here?

The New York Times editorial this morning has some broadstrokes of what fixes are needed to get this puppy passed a second time around.

Since last week, this page has urged Congress to take the time to get the bailout right. Over all, lawmakers have given too little consideration, in public at least, to alternatives to the Treasury’s plan to buy up the bad assets from various financial firms.

In the bill rejected on Monday, the unlimited powers that the Treasury Department had initially sought were curbed, and Congressional oversight was added. But judicial review of Treasury’s purchases was not adequately ensured. The courthouse door was not closed entirely; lawyers could still seek effective remedies for actions that violate the Constitution. But that’s a much higher hurdle than the already formidable barriers in place to discourage lawsuits against the government.

Homeowners were also given short shrift with provisions that mainly urged lenders and the Treasury to do more to help them. That’s unconscionable. The financial crisis is as much a problem for homeowners as for Wall Street investment bankers. Appeals to lenders’ better natures have not worked to bring lasting relief to homeowners. If they are still not working in the coming months, Congress will have to revisit the issue.

Taxpayer protections are also iffy, such as a requirement that in five years, the president must give Congress a plan for recouping any losses from financial firms. What will happen then is anyone’s guess. Lawmakers could decide at that point that taxpayers are the only pit bottomless enough to absorb those losses.

Today’s LA Times editorial is less specific but, in its general way, says the same thing.

Congress may take up a very similar bailout proposal later this week. In the meantime, Bush and top administration officials need to speak more often and more persuasively about the nature of the problem. They need to distance themselves from Paulson’s initial request for unfettered authority and embrace the oversight Congress demanded. Meanwhile, lawmakers need to stop trying to turn the bailout plan into a referendum on the administration’s policies, presidential candidates or anything other than the specifics of the proposal. Opponents can and should try to reduce its cost and increase market discipline. But they can’t pretend that it’s someone else’s problem to fix.

No. They can’t. Again, Congress needs to improve the bailout the best it can, and pass it.

Then let’s elect a president with some sense and begin to reform and rebuild. Please.

(NOTE: Only the chorus of this song really applies to the subject at hand. But, Tom Waits still feels like he’s right for this week’s soundtrack.)

Several really good posts on the bailout/recuse, Celeste.

A song for the economy is kinda like dancing about architure. But I dig the impulse. Love Tom Waits, too. Here’s my ‘econ groove’:

http://www.youtube.com/watch?v=V7WPvhhDPU0

Thanks. And great song, Ishmael. (I just find music helpful for….well….everything.)